Buying and Selling in a Transitioning Market

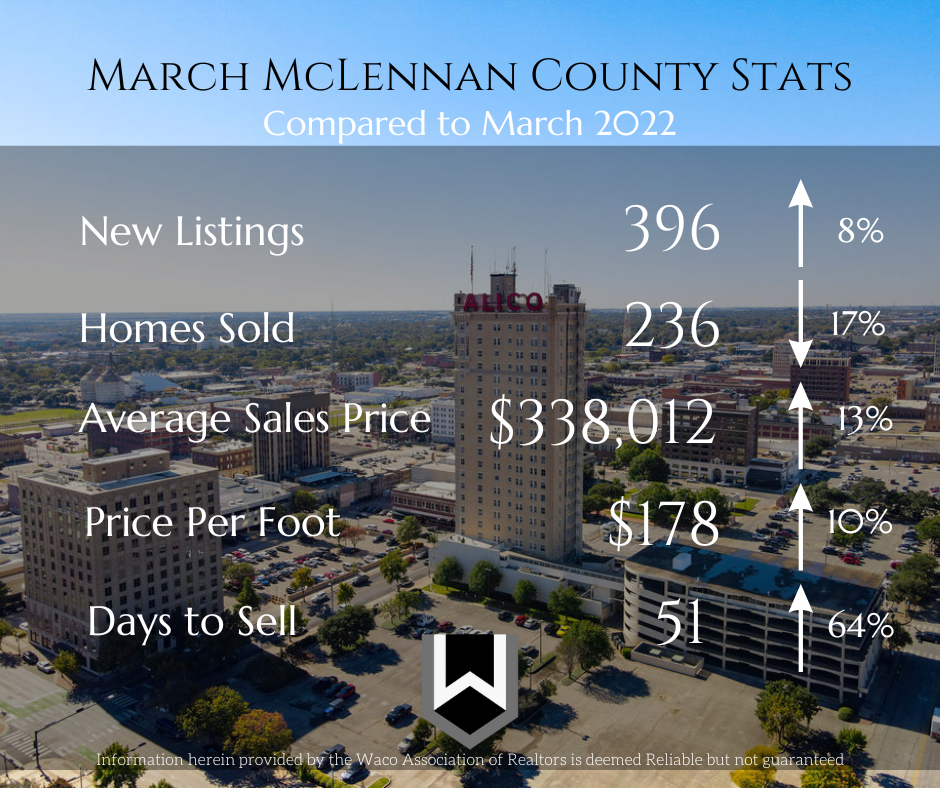

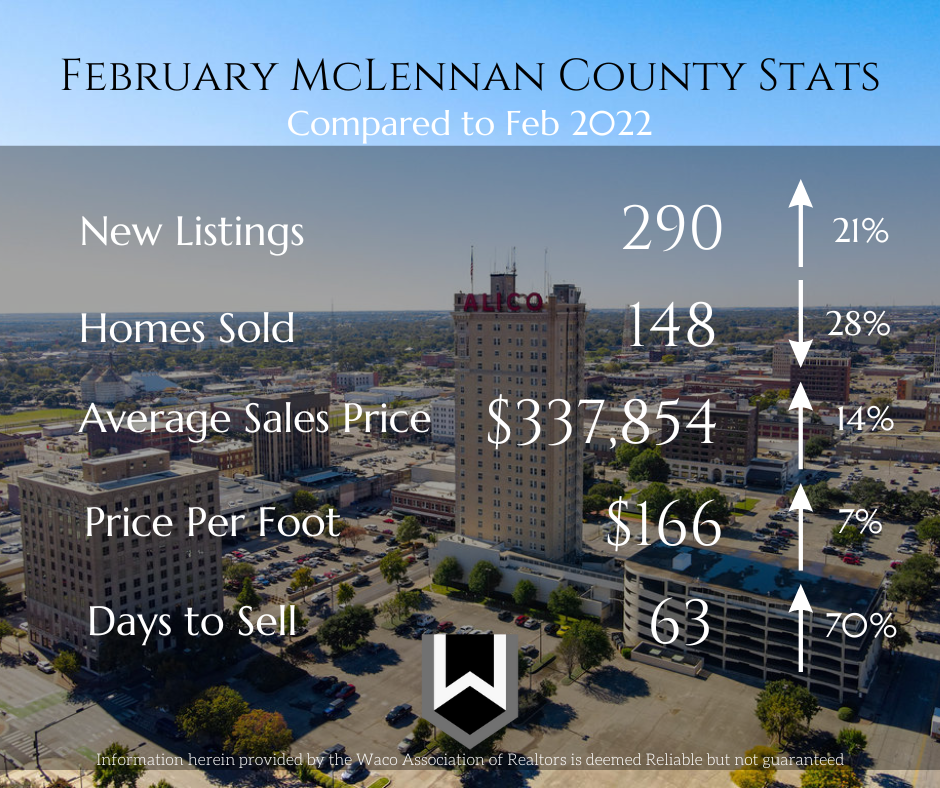

In the real estate world, the market is constantly evolving. Currently, we find ourselves in a transitioning market where inventory is up and properties are taking longer to sell. Despite this shift, prices have remained steady for over a year. This unique scenario brings about different opportuniti

Buy, Sell or Wait?

Home prices have seen a sharp rise over the last 2 years and today’s mortgage rates are at a 14 year high. Many people are wondering if now is the time to buy, sell or simply wait for the housing market to settle down. The decision to buy now can be a stressful one, but waiting too long can present

Types of Financing in Real Estate

When it comes to real estate, financing is one of the most important aspects to consider. Whether you’re a buyer or an investor, it’s essential to understand the different types of financing available to you. In this blog post, we’ll be discussing some common types of financing in real estate, inclu

Categories